What is Uniswap?

Uniswap stands as a pioneering decentralized exchange, functioning within the Ethereum blockchain framework. This platform revolutionizes cryptocurrency trading by enabling direct peer-to-peer interaction among traders. Distinctively, Uniswap forgoes the traditional use of order books or third-party facilitators. Its core functionality is driven by an innovative automated liquidity protocol, managed by Automated Market Makers (AMM), ensuring a seamless and efficient trading experience.

How does Uniswap work?

Uniswap operates through a well-orchestrated ecosystem comprising multiple elements that work in harmony to ensure its automation system functions seamlessly around the clock. Each component within this ecosystem plays a vital role in maintaining continuous and uninterrupted operation, making the platform efficient and reliable for users at all times.

Automated Market Maker (AMM)

Automated Market Makers (AMMs) serve as the cornerstone of the Uniswap platform. Unlike traditional trading systems that rely on order books to pair buyers and sellers, AMMs utilize liquidity pools to facilitate seamless trading. These liquidity pools are essential in providing consistent liquidity within the decentralized finance (DeFi) ecosystem, supporting transactional activities.

In contrast to conventional markets, which operate under the guidance of centralized entities and involve direct interaction between buyers and sellers, AMMs in Uniswap operate on a decentralized, permissionless basis. Here, users contribute their cryptocurrency tokens to liquidity pools. The value of tokens within these pools is governed by a specific mathematical formula, ensuring fair and automated pricing.

Central to Uniswap’s functionality is its AMM mechanism, encapsulated in a smart contract that oversees these liquidity pools. This smart contract is activated during trade execution on the decentralized exchange (DEX). It employs an algorithm to accurately determine the market price of tokens in real-time, based on the dynamics of supply and demand involving the traded ERC-20 tokens and their respective liquidity pools.

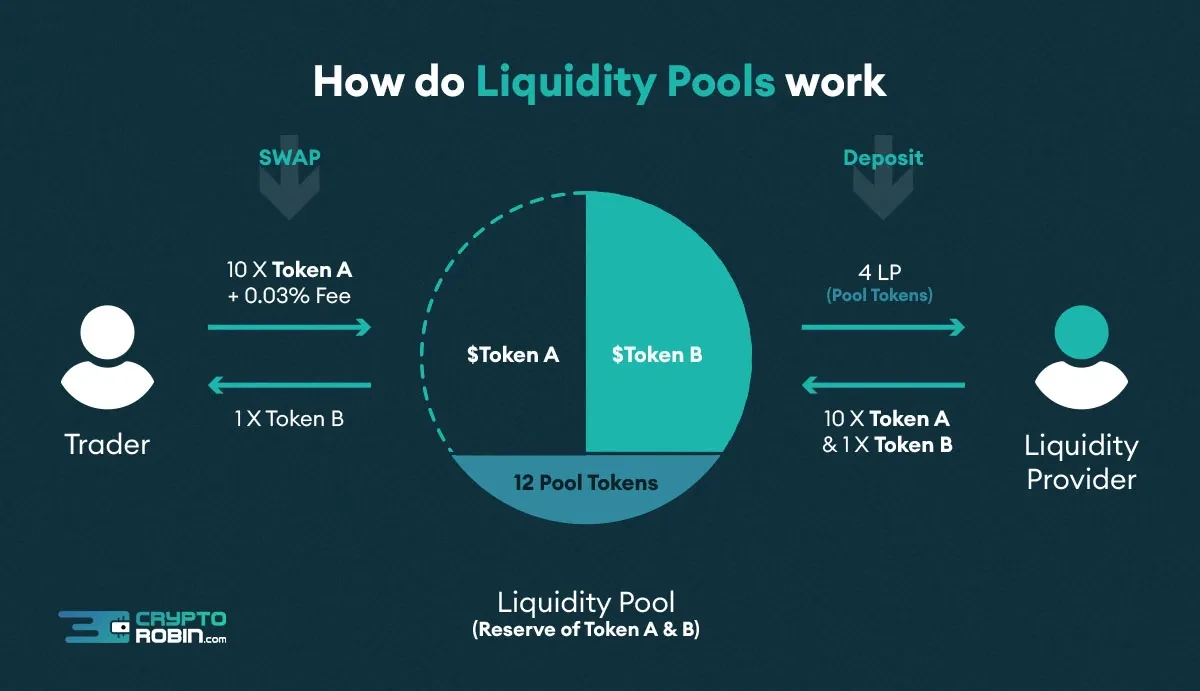

Liquidity pool and liquidity providers

In the realm of finance, liquidity is defined as the ability to swiftly convert assets from one form to another without significantly impacting the market price. Initially, decentralized exchanges (DEXs) grappled with liquidity challenges. The innovative nature of this technology led to hesitancy among users to actively engage in the ecosystem.

However, the advent of Automated Market Makers (AMMs) brought a transformative solution to the liquidity issues in DEXs. By establishing liquidity pools and offering incentives to liquidity providers, AMMs significantly enhanced the functionality of DEXs.

A liquidity pool is essentially a collective reserve of cryptocurrencies or tokens, pooled together to enable decentralized trading. These pools are managed through smart contracts, which are programmed by developers to autonomously set the prices of the tokens within the pool. A liquidity provider is an individual who contributes tokens to these pools, thereby aiding in maintaining liquidity within a DEX or the broader DeFi ecosystem.

In Uniswap, these contributors, also known as stakers or liquidity providers, play a crucial role. When transactions occur on Uniswap, traders incur a fee, typically around 0.3%. This fee is then distributed among the liquidity providers in proportion to their share in the liquidity pool, effectively rewarding them for their contribution to maintaining the platform’s liquidity.

The Uniswap constant product formula

Uniswap employs a unique mechanism known as the constant product formula to ensure a stable and ample supply of liquidity for each cryptocurrency pair it supports. This formula is a key component in managing the relationship between different tokens in a pair. It operates by treating the individual tokens within a pair as variables.

When a user withdraws one type of token in exchange for another within the platform, the constant product formula comes into play. It adeptly balances the supply and demand ratio, as well as the pricing between the two tokens in the pair. This programmed formula is crucial in maintaining a fair market value for the tokens, while simultaneously ensuring that liquidity is not compromised. Through this approach, Uniswap effectively stabilizes trading conditions, allowing for efficient and equitable transactions.

Arbitrage traders

Pricing efficiency is a vital aspect of any decentralized exchange (DEX), as users seek to avoid excessive slippage and wide bid-ask spreads in their token swaps. This is where the role of arbitrage traders becomes pivotal within the Uniswap ecosystem. Arbitrage traders specialize in identifying price disparities across various centralized exchanges (CEXs) and DEXs and leverage these differences for profit.

For instance, if Bitcoin is trading at $42,800 on a CEX like OKX but is priced at $42,750 on Uniswap, arbitrage traders seize the opportunity by purchasing BTC on Uniswap and selling it on OKX, thereby securing a lower-risk profit.

Arbitrage traders on Uniswap closely monitor coins and tokens that are trading above or below their average market prices. These deviations typically arise from significant block trades that create imbalances within the liquidity pool, leading to price fluctuations that often go unnoticed. Arbitrage traders step in to trade these cryptocurrencies until pricing efficiency is restored, aligning crypto prices with those on other exchanges. This symbiotic relationship benefits both the AMM and arbitrage traders — the AMM achieves its goal of maintaining efficient prices for its tokens, harmonizing them with other DEXs and CEXs in the market, while arbitrage traders reap the rewards of lower-risk gains.

How has Uniswap evolved?

Since its inception in 2018, Uniswap has undergone significant transformations through a series of updates and protocol refinements, resulting in distinct protocol versions.

Uniswap v1

Uniswap v1 marked the earliest iteration of the protocol, embodying the fundamental characteristics of a decentralized exchange (DEX). While it generated considerable excitement within the crypto community, its primary function was to facilitate the direct trading of ERC-20 tokens on the Ethereum blockchain. Uniswap v1 served as a pioneering implementation of Automated Market Makers (AMMs) and effectively demonstrated the concept’s feasibility.

Uniswap v2

In 2020, Uniswap underwent its first major upgrade with the introduction of Uniswap v2. A noteworthy enhancement of Uniswap v2 was the introduction of ERC-20 to ERC-20 trading pairs. This version empowered liquidity providers to create pair contracts for any two ERC-20 tokens, eliminating the necessity of Ethereum (ETH) as an intermediary token for trading between ERC-20 assets.

Uniswap v2 also brought several additional benefits, including reduced gas fees, enhanced operational efficiency, and the introduction of flash swaps. These improvements substantially bolstered the visibility and acceptance of AMMs, establishing Uniswap as one of the foremost decentralized exchanges (DEXs) in the crypto ecosystem.

Uniswap v3

The current iteration of Uniswap, Uniswap v3, incorporates a groundbreaking feature allowing liquidity providers to define custom price ranges within which they offer liquidity. This means that a liquidity provider can specify a trading range, such as $1,000 to $5,000, restricting trades to occur only within that designated price range. This innovation effectively addresses the issue of capital inefficiency associated with undefined liquidity ranges, further enhancing Uniswap’s capabilities as a leading DEX.”

The Uniswap (UNI) token

Uniswap, despite its initial launch in 2018, introduced its native token in 2020. UNI made its debut as a governance token integrated into the Uniswap ecosystem. This particular cryptocurrency operates as an ERC-20 token, developed on the Ethereum platform, and is compatible with any ERC-20 wallet.

UNI holders are bestowed with the valuable privilege of participating in the decision-making process for the continuous enhancement of the Uniswap protocol. Similar to other governance tokens, the extent of a UNI holder’s influence through voting is directly proportional to the quantity of UNI tokens they possess. Notably, Uniswap’s voting system is characterized by its decentralized nature, enabling anyone who holds UNI tokens to propose and cast their votes as the need arises.

Uniswap (UNI) tokenomics

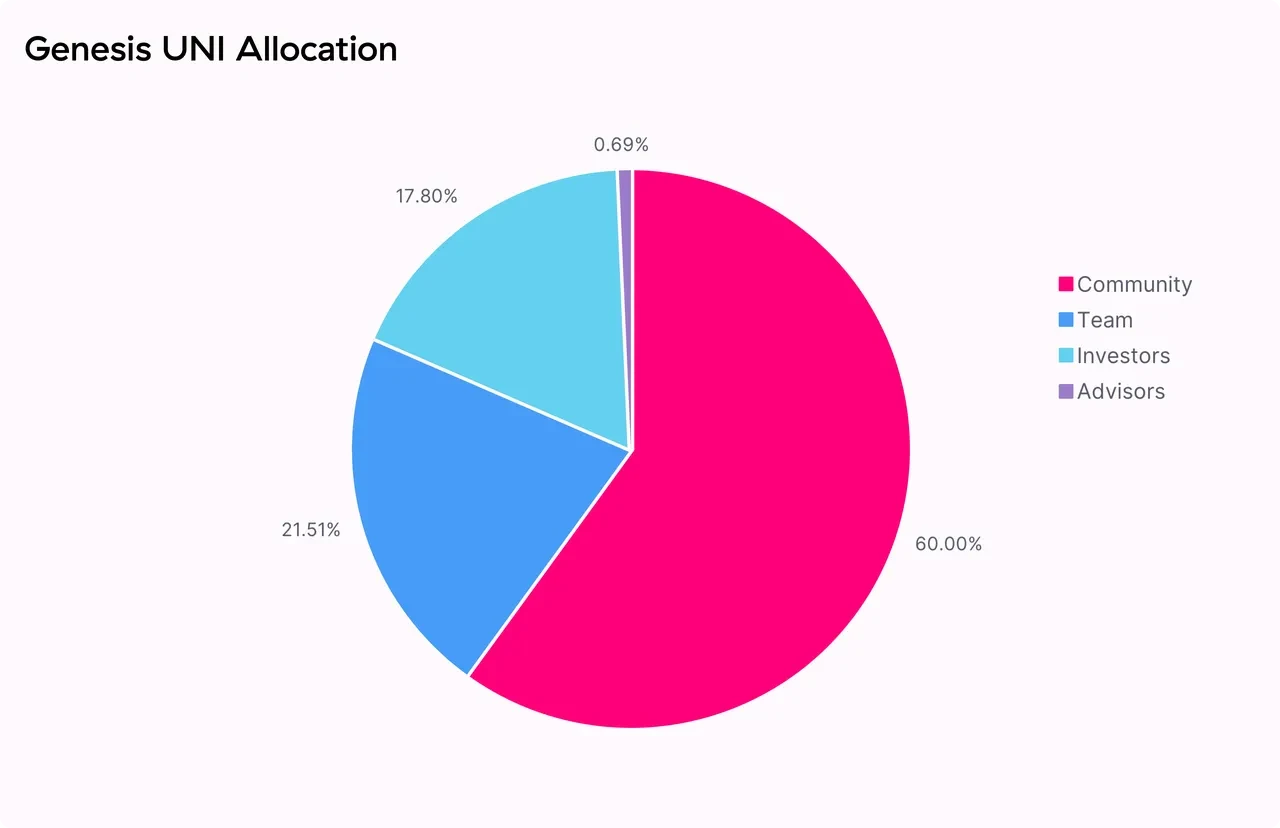

In terms of tokenomics, UNI boasts a maximum supply of 1,000,000,000 tokens, of which 753,766,667 UNI tokens are currently in circulation. As of mid-December 2023, UNI was trading at $6.33 per token, reflecting an 85.9% decline from its all-time high of $44.97 reached on May 3, 2021.

A noteworthy aspect of UNI’s distribution strategy is that a substantial 60% of the total token supply has been allocated to the community. These UNI tokens have primarily been disseminated to early adopters of the Uniswap platform who actively engaged with the decentralized exchange (DEX) by conducting swaps and trades.

It’s important to highlight that UNI features a perpetual 2% annual inflation rate, which will become active once the token reaches its maximum supply and is entirely distributed. This strategic inflation mechanism, as outlined by Uniswap, aims to incentivize and sustain ongoing participation and contributions to the Uniswap DEX.

Utility of UNI

There has been an ongoing discussion among commentators regarding the utility of UNI tokens, with some asserting that they primarily serve as governance and voting rights tools for shaping the future of Uniswap. This distinguishes UNI from other decentralized exchange (DEX) tokens such as CAKE and JOE, which offer enticing incentives for token holders, including bonus staking rewards, reduced trading fees, and a share of trading revenue.

This divergence in utility has sparked conversations about the perceived disconnect between UNI tokens and the success of Uniswap as a DEX. While Uniswap continues to thrive by attracting traders and facilitating token swaps, many argue that holding UNI tokens for the long term doesn’t provide substantial advantages beyond the hope that their value may eventually be transferred to token holders.

Although there have been speculations about potential future benefits, the primary motivation for crypto traders to hold UNI tokens currently revolves around securing voting rights in governance decisions. This aligns with Uniswap’s fundamental vision of offering limited benefits to UNI token holders while upholding the principle that the Uniswap platform remains a public good owned and governed by UNI holders.

Trading on Uniswap DEX

Trading on Uniswap DEX sets itself apart from traditional centralized exchanges with its unique approach. To embark on your trading journey within the Uniswap ecosystem, it’s essential to follow these straightforward steps:

- Commence your Uniswap experience by navigating to the official Uniswap website. Here, you’ll seamlessly connect your Ethereum wallet.

- Within the wide array of ERC-20 tokens at your disposal, pick the specific token you intend to trade on Uniswap.

- Specify the quantity of your chosen ERC-20 token that you wish to exchange. The platform will perform an instant calculation to determine the approximate amount of the alternative token you’ll acquire in return.

- Initiate the trade by clicking on the “Swap” icon. Confirm the transaction through the subsequent prompt that appears.

- With your confirmation, the trade will execute promptly, and the tokens will promptly find their place in your wallet, ready for your next move.

Uniswap's impact on the DeFi sector

Uniswap has significantly shaped the DeFi sector, playing a pivotal role in its growth. It has achieved this by supporting decentralized exchange infrastructure, permitting open token listings, facilitating liquidity provision, enhancing token price discovery, and promoting interoperability.

Uniswap is widely regarded as the catalyst behind the current DeFi revolution in the cryptocurrency industry. Moreover, it has empowered users to earn passive income by participating in liquidity pools and sharing in transaction fees based on their contribution. This innovative approach underscores Uniswap’s pivotal role in the DeFi landscape.

The final word and next steps

In summary, Uniswap is the leading DEX in the DeFi sector, boasting the highest trading volume. Its innovative approach with AMMs and extensive token offerings positions it as a long-term leader. UNI tokens grant governance power, with each token equating to one vote, allowing users to influence Uniswap’s future development as a DEX.