The relationship between Ethereum’s value and Bitcoin has recently hit a record low, amidst growing market excitement for the potential release of a spot exchange-traded fund (ETF) in the United States.

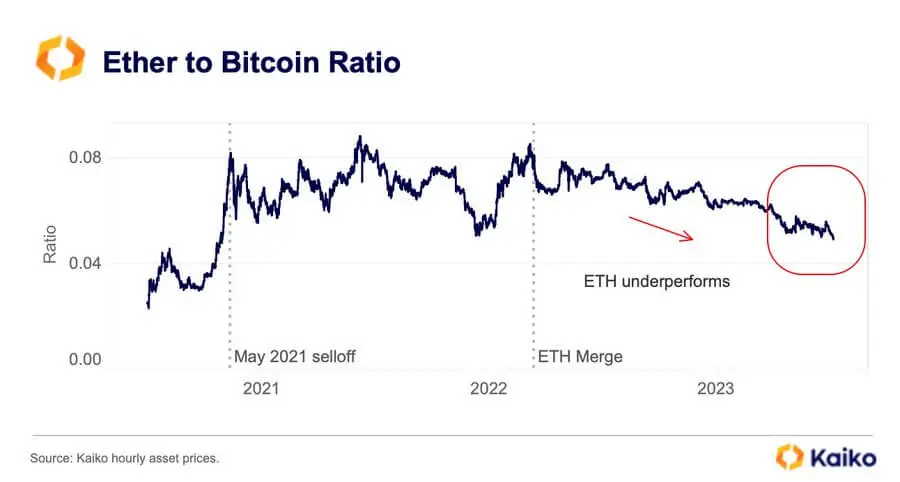

Recent analytics from Kaiko, a crypto intelligence agency based in Paris, indicate that the ETH/BTC ratio has been in a consistent decline since Ethereum’s shift to a proof-of-stake network in September 2022. This ratio has fallen to 0.048 in the last 24 hours, marking its lowest point since May 2021.

This ratio is a key metric for assessing Ethereum’s market performance in comparison to Bitcoin. A rising ETH/BTC ratio means that Ethereum is either gaining strength or maintaining its value better than Bitcoin, suggesting a market preference for Ethereum over Bitcoin.

On the flip side, a decreasing ETH/BTC ratio points to Ethereum’s diminishing performance relative to Bitcoin, possibly indicating a shift in investor preference towards the more traditionally stable Bitcoin.

This ratio is a comprehensive indicator, encompassing not just the price movements but also the shifts in investor confidence and market sentiment towards these two dominant cryptocurrencies.

Over the past year, Bitcoin’s price performance has been stellar compared to Ethereum’s. Bitcoin has seen its value increase by over 170%, reaching a high not seen in 21 months at over $47,000. Ethereum, however, has only managed a modest gain of 74%.

Bitcoin’s price surge is likely connected to the optimism and anticipation surrounding the approval of a spot ETF. In recent months, various asset managers, including industry giants like BlackRock, VanEck, and Grayscale, have been in discussions with the U.S. Securities and Exchange Commission (SEC) regarding ETF applications, fueling speculation that these financial products might start trading very soon.

In contrast, Ethereum’s lackluster price performance is observed in the backdrop of the introduction of several futures-based ETFs for the digital asset last year. These ETFs did not significantly impact the market, experiencing only mild demand, which led to Ethereum being perceived as less favored in comparison to other altcoins like Solana.