Financial oversight bodies are intensifying their efforts against the anonymous nature of cryptocurrencies, thereby impacting privacy coins significantly. This has led to prominent trading platforms progressively removing or limiting transactions involving privacy coins. Recently, in December, the situation escalated when OKX decided to remove several tokens centered on privacy, such as Monero, ZCash, and Dash. This action has resulted in an unprecedented decline in the market liquidity for privacy tokens.

Privacy Token Liquidity Dries Up

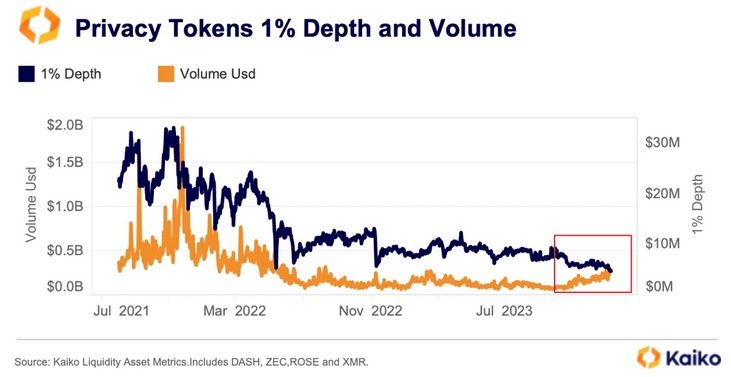

Data obtained from Kaiko reveals that the liquidity of privacy tokens has plummeted, reaching a historic low at merely $5 million. This figure is derived from evaluating the market depth at a 1% threshold. The significant decrease in liquidity is largely ascribed to the actions of OKX, specifically the delisting in December which led to the removal of various privacy tokens from their trading list.

Market depth serves as a key indicator of an asset’s liquidity, indicating the potential impact of new orders on its price. In the context of Kaiko’s analysis, this pertains to the aggregate value of pending buy and sell orders on exchanges, calculated within a 1% range of the prevailing market price.

In November 2021, during the height of the cryptocurrency market’s success and relatively free from intense regulatory pressures, the same metric showcased a market depth of 1%, amounting to $34 million. Yet, the market depth for privacy tokens has seen a downward trend since that time, experiencing significant declines in tandem with key negative market events, including the Terra debacle in May 2022 and the FTX controversy in November 2022.