In the early days of cryptocurrency, centralization played a pivotal role in the industry’s landscape. Despite the push for decentralization within crypto projects, trading assets remained confined to centralized exchanges (CEXs) for users. Attempts to establish decentralized exchanges (DEXs) were made by developers over time, yet these endeavors largely faltered due to a fundamental issue: insufficient liquidity.

This narrative underwent a transformation upon the introduction of Uniswap, which pioneered the use of Automated Market Maker (AMM) mechanisms to bolster liquidity. Suddenly, a new epoch for DEXs emerged, leading to a proliferation of these platforms. This guide aims to delineate the concept of DEXs and elucidate their operational mechanisms. Additionally, it will feature a compilation of some of the top decentralized exchanges currently available.

What is a decentralized exchange?

Decentralized exchanges (DEXs) stand out as peer-to-peer (P2P) trading platforms that operate without the control of a centralized entity. While sharing some similarities with centralized platforms, DEXs largely diverge in their fundamental structure. Key disparities include their lack of singular ownership and operation by an individual entity. Moreover, they don’t mandate users to deposit funds into a specific wallet for trading, essentially functioning as non-custodial trading platforms.

Typically, DEXs exclusively offer assets native to the same blockchain as the exchange. Nevertheless, cross-chain DEXs have emerged, enabling the utilization of assets from diverse blockchain networks. These exchanges function via smart contracts, sidestepping the necessity for traditional order books to match traders. Instead, they rely on Automated Market Makers (AMMs) and liquidity pools sourced from other users’ provided funds.

Furthermore, DEXs commonly boast substantially lower trading fees and heightened security measures compared to their centralized counterparts. This combination of factors contributes to their appeal and growing popularity within the cryptocurrency trading landscape.

17 Best decentralized exchanges available right now

1. Uniswap

The top-ranking decentralized exchange on the list is Uniswap, hailed as Ethereum’s initial and most extensive DEX. Renowned for asset growth opportunities, Uniswap boasts immense popularity, often witnessing a daily trading volume surpassing $4 billion. Operating as an Automated Market Maker (AMM) DEX, Uniswap orchestrates its decentralized liquidity pool using an algorithm to optimize swap rates for each trading pair.

Users can either tap into existing liquidity pools or establish their own, with liquidity providers earning a share of trading fees. Notably, the platform operates under the governance of a decentralized autonomous organization (DAO), entrusting its control to its user base.

Pros:

- Offers access to over 400 tokens

- Esteemed, well-established exchange platform

- High trading volumes ensure market activity

- DAO-governed, placing control in the hands of users

- Allows users to earn passive income through staking

- Transaction fees range from 0.1% to 1%

Cons:

- No support for fiat transactions

- Risk of impermanent loss is inherent

- Incurs gas fees, impacting transaction costs

Next in line is OKX DEX, distinguished as a cross-chain, multi-chain DEX aggregator striving to offer users the most favorable transactions spanning over 20+ chains, 300+ DEXs, and an extensive array of 200,000+ coins. Anchored on decentralization, OKX’s DEX champions a secure, borderless trading platform that operates on a non-custodial basis.

This DEX promises a seamless trading experience coupled with relatively reduced trading fees. Its emphasis on delivering a more refined and specialized infrastructure compared to Ethereum marks it as an appealing option for DApps, DEXs, and various other blockchain products.

Pros:

- High-security standards ensure a safe trading environment

- Non-custodial platform, offering users control over their assets

- Competitive exchange rates bolster trading efficiency

- Utilizes a call auction mechanism for order matching

- User-friendly design enhances accessibility and usability

- Operates under decentralized governance, fostering community involvement

- Approval-free listing streamlines the process for token inclusion

- Provides a cross-chain gateway for enhanced accessibility and interoperability

Cons:

- Some cryptocurrencies face low liquidity, potentially affecting trading opportunities

- Lack of upfront display of commissions until an order is created might lead to uncertainty or surprise costs

3. ApeX Pro

ApeX Pro stands out among the best decentralized exchanges, credited for its innovative elastic Automated Market Maker (AMM) model. This model not only enhances capital efficiency but also renders transactions akin to spot trading. Notably, it incorporates an order book interface, simplifying the platform’s usability for novices.

A distinguishing feature is the integration of StarkWare’s layer 2 scalability engine, bolstering the exchange’s security measures. Should the DEX face any service interruptions, traders can rely on this engine to recover their funds. Additionally, the platform offers up to 20x leverage for any token available on the derivatives market, expanding trading possibilities for users.

Pros:

- High-performance infrastructure ensures efficient trading

- Emphasis on robust security measures and user privacy

- Low fees contribute to cost-effective trading experiences

- High leverage options provide increased trading potential

- Incorporation of an order book model simplifies trading processes

Cons:

- Limited availability of trading instruments may restrict diverse investment opportunities

- Lack of tiered fees might affect flexibility in fee structures for different trading volumes or user tiers

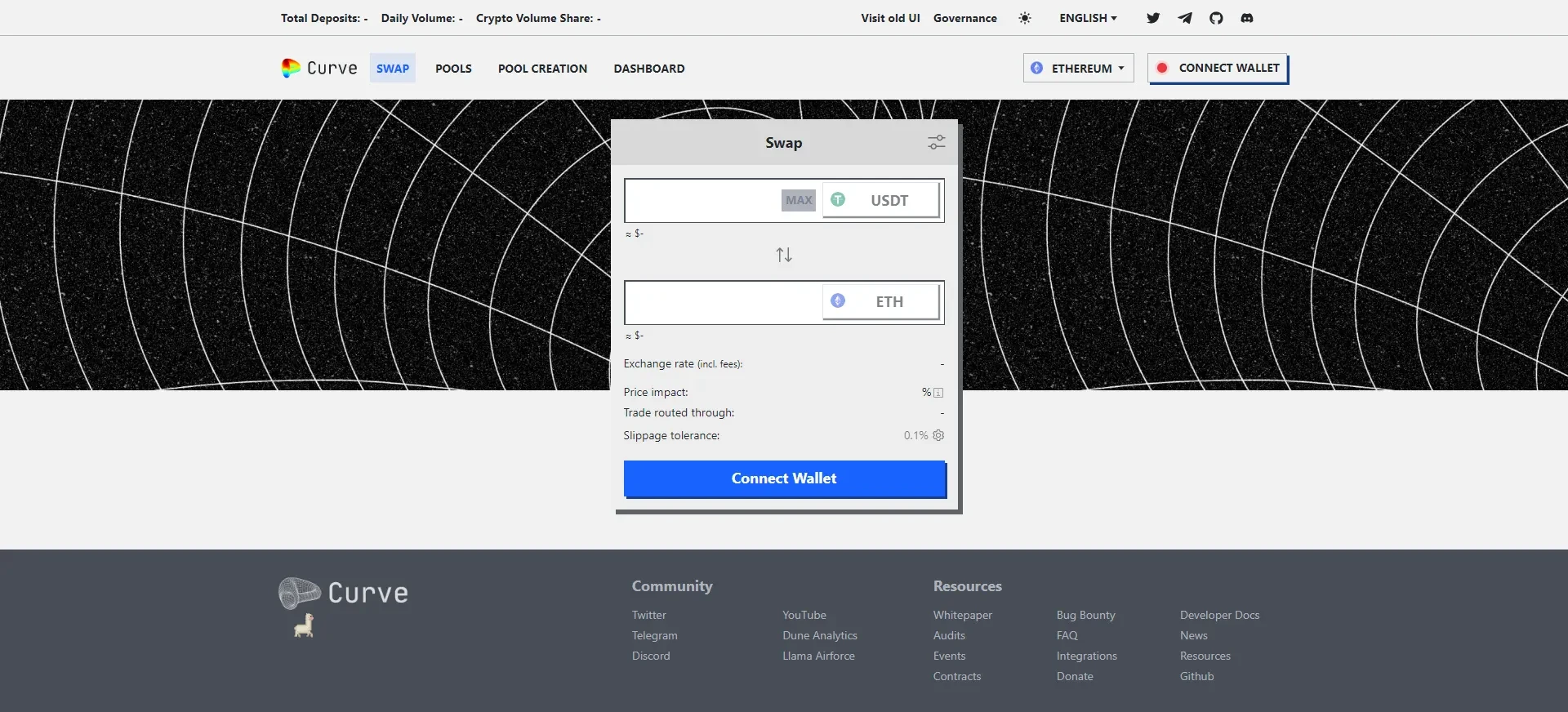

4. Curve

Curve stands as a premier DEX particularly suited for traders concerned about market volatility. Similar to Uniswap, Curve operates as an AMM DEX within Ethereum’s decentralized network. However, it boasts distinctive attributes. Notably, it introduces its native token, CRV, which plays a pivotal role in governance by endowing voting rights to its holders. This unique feature sets Curve apart within the DEX landscape.

Pros:

- Extensive offering of over 45 tokens provides diverse trading options

- Transaction fees approximately around 0.04%, ensuring cost-effective trading

- Token holders’ ability to partake in crucial decision-making through voting rights

Cons:

- Steep learning curve attributed to a complex interface might deter ease of use for newcomers

- High gas fees pose a challenge, impacting transaction costs and affordability

5. KyberSwap

Fifth in the lineup of top-tier DEXs is KyberSwap, the flagship product of Kyber Network. Often likened to Uniswap, KyberSwap operates as an AMM DEX but distinguishes itself with unique features. The platform functions with multiple liquidity pools, notable for their depth surpassing that of many other DEXs. This depth has led numerous DeFi applications to integrate KyberSwap as their foundational protocol. Liquidity providers benefit from a 0.3% fee for each trade involving a specific pair, earning rewards and trading fees in KNC, the platform’s native token.

Pros:

- Support for over 1,500 tokens broadens trading possibilities

- Offers thousands of available swap pairs for diverse trading options

- Liquidity providers receive a 0.3% fee, incentivizing participation

- Provides staking, farming, and DApp solutions for users’ varied needs

Cons:

- Absence of support for fiat deposits limits accessibility for certain users

- Lack of a dedicated mobile app might hinder on-the-go trading convenience

- Complexity in platform usage might pose challenges for new traders navigating the interface

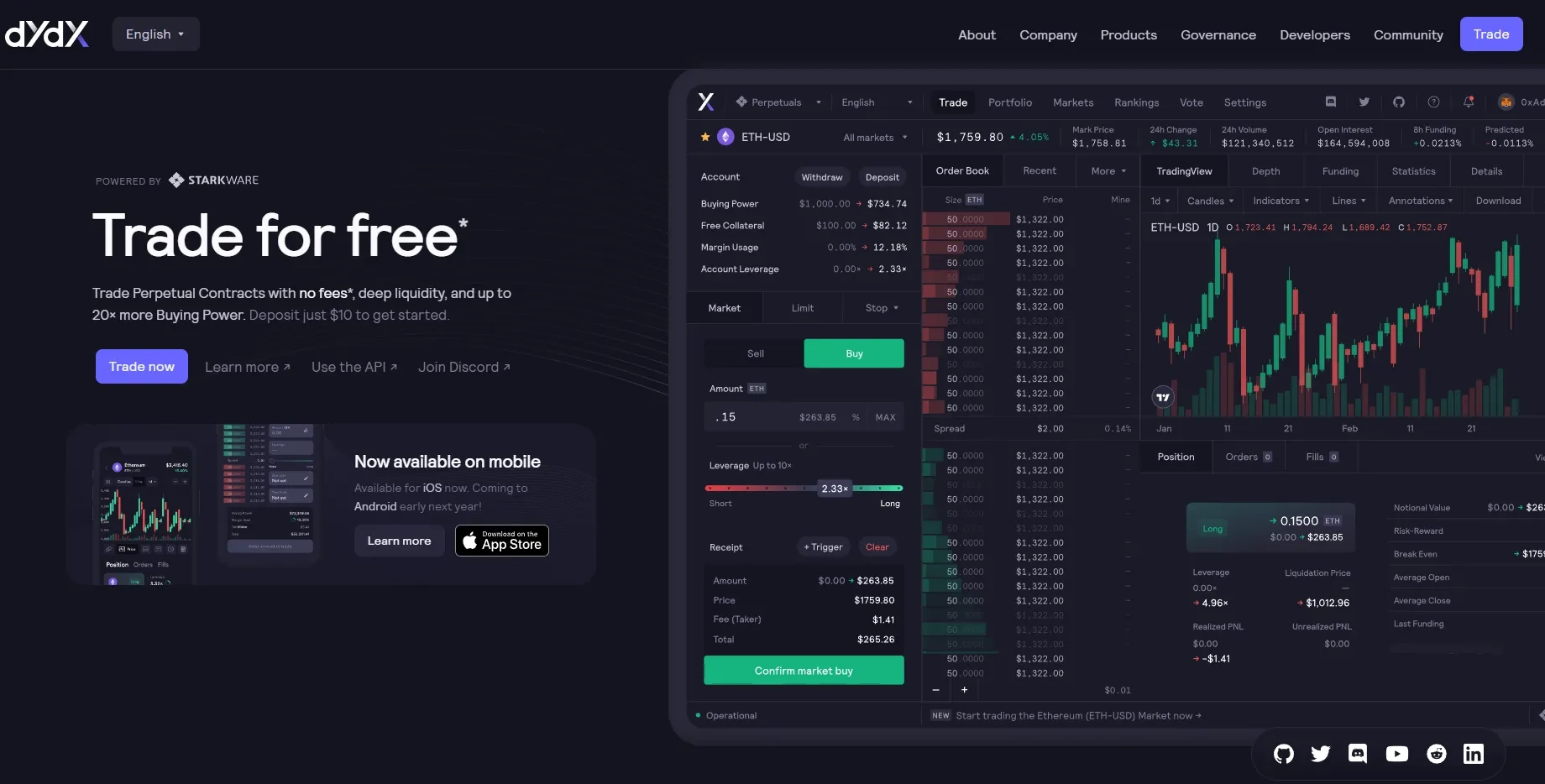

6. dYdX

dYdX stands out from other DEXs by adopting an order book model, resembling a more traditional crypto market trading experience while retaining unique functionalities. Notably, it permits leveraged trading up to 5x the invested amount for ETH, allowing users to take long or short positions. Furthermore, the platform doubles as a lending service, featuring cross-margin lending and borrowing, enabling users to earn passive income by keeping funds on the platform. Additionally, assets actively engaged in trading can generate interest. dYdX ranks second only to Uniswap in trading volume, highlighting its substantial market presence.

Pros:

User-friendly interface enhances accessibility

Second-highest trading volume among DEXs showcases market relevance

Availability of a mobile app for on-the-go trading convenience

Low trading fees set at only 0.1%

Offers leveraged trading, expanding trading potential

Various avenues to generate passive earnings through lending and interest Cons:

Lack of support for fiat deposits restricts accessibility for some users

Limited range of trading options compared to other platforms

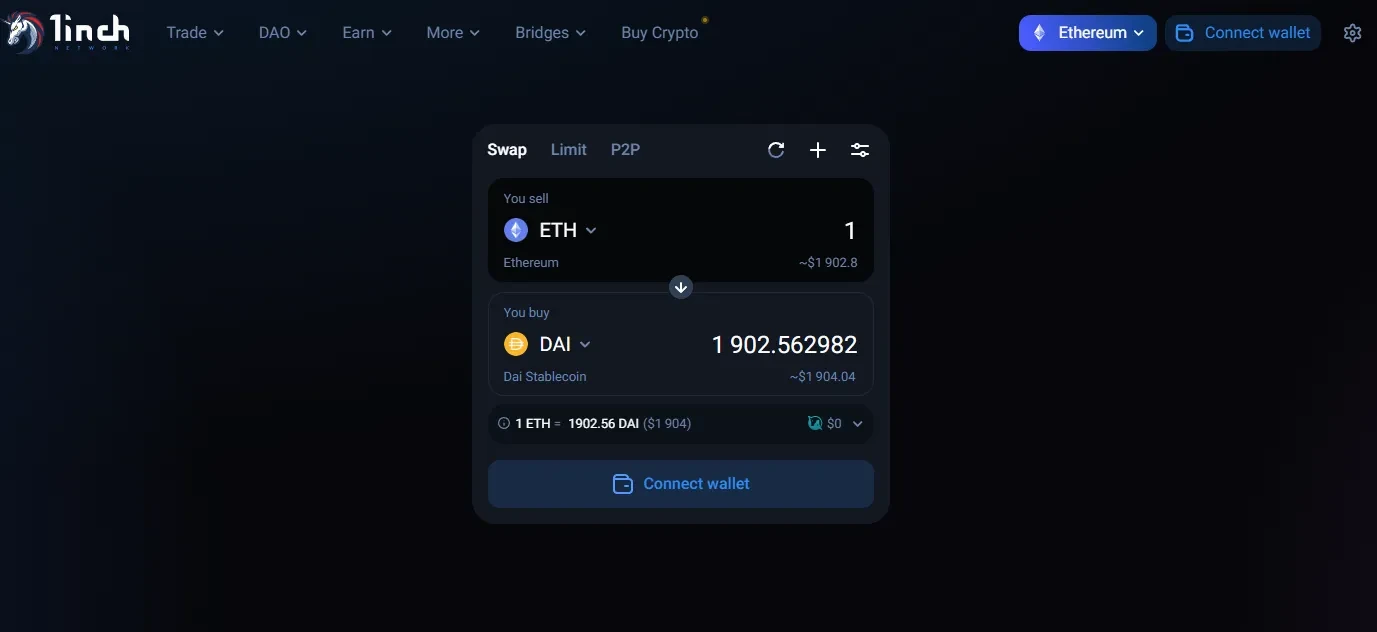

7. 1inch

The seventh platform highlighted is 1inch, renowned for its seamless crypto trading experience and distinguished as the top DEX aggregator. Utilizing a unique approach, the platform scans multiple DEXs before each transaction, ensuring users access the most favorable prices when purchasing tokens. Furthermore, its liquidity pool empowers users to stake tokens, earning rewards in 1INCH tokens, which also grant voting rights to holders.

Pros:

- Offers a diverse selection of over 400 tokens for trading

- Zero transaction fees present a cost-effective advantage

- 1INCH token holders have governance participation rights

- Provides excellent exchange rates, optimizing trading efficiency

Cons:

- Transaction fees imposed by other DEXs might impact overall costs

- Complexity in platform usage might present challenges for new traders navigating the interface

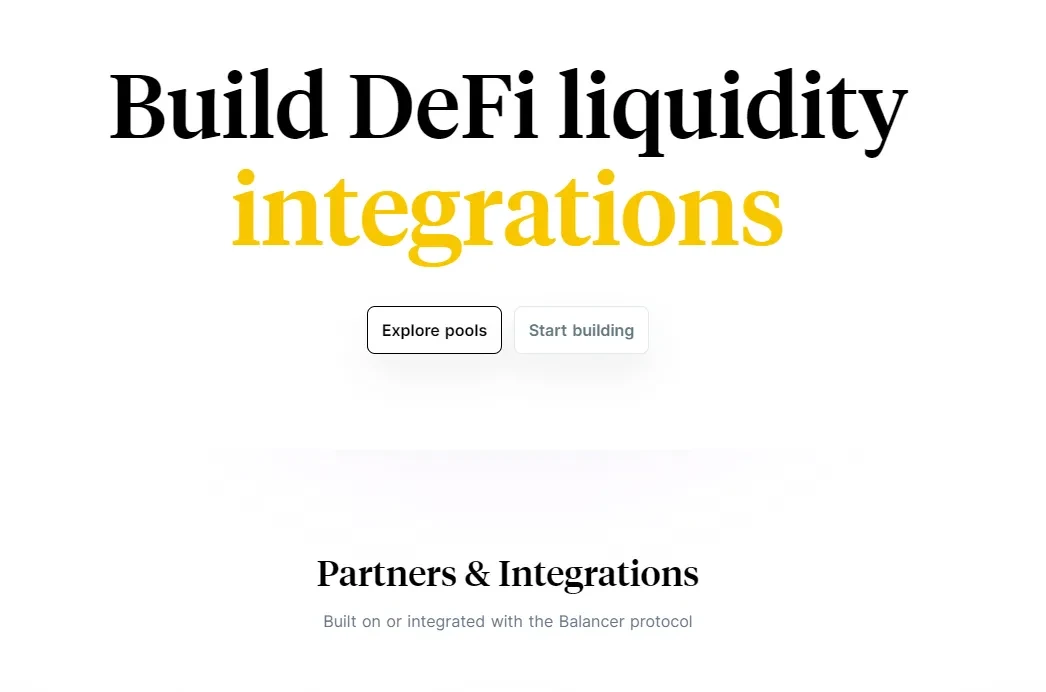

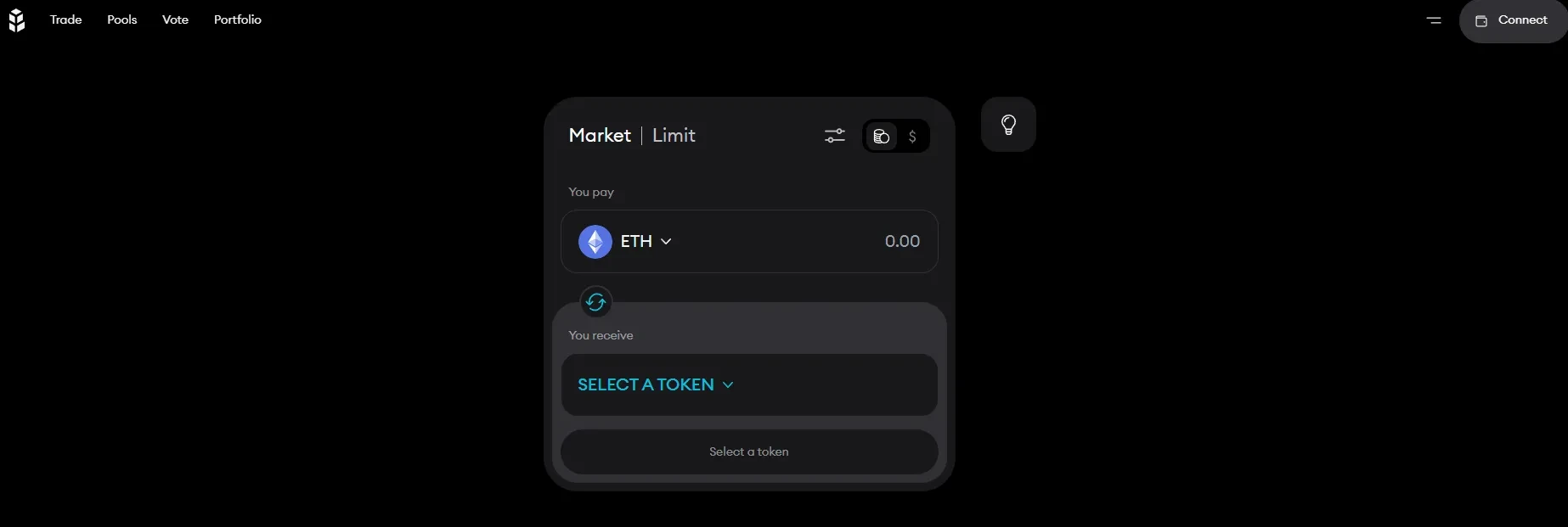

8. Balancer

Another notable Ethereum-based DEX is Balancer, designed for swift trade execution through smart contracts and liquidity pool utilization. Operating as an AMM, Balancer offers users access to various liquidity pools, allowing them to create customized pools from three available types: smart pools, private pools, and shared pools.

Pros:

- Gas-free payments, a unique feature despite its Ethereum integration

- Diverse pool options for users creating their pools

- User-friendly interface for quick and straightforward usage

- Offers opportunities for passive earnings through its functionalities

Cons:

- Transaction fees can fluctuate based on pool owners, ranging from 0.0001% to 10%, potentially impacting trading costs.

9. Bancor

Bancor stands out as another reputable DEX in the cryptocurrency sphere. Pioneering as one of the earliest AMMs on Ethereum since 2017, Bancor’s hallmark is its instantaneous trade finalization powered by automatic liquidity, positioning it favorably among many traders. The platform’s native token, BNT, streamlines swift and seamless payments. Bancor’s staking mechanism mitigates impermanent loss through multiple pools, offering substantial rewards both from staking activities and BNT contributions. Particularly, optimal rewards accrue to users staking BNT and other cryptocurrencies simultaneously.

Pros:

Established reputation instills trust among users

Shields users from impermanent loss, enhancing investment security

Maintains relatively low exchange fees, offering cost-effective trading Cons:

Absence of fiat support restricts accessibility for certain users

Mandates asset storage within the Bancor wallet, limiting flexibility for users to manage assets externally

10. Slingshot

Slingshot, a well-received Ethereum-based swapping protocol established in 2020, boasts a distinctive feature of 0% fees. This platform facilitates various crypto operations including searching, sending, receiving, and swapping tokens. Available across mobile and desktop platforms, Slingshot provides support across multiple chains and offers bridging functionalities for networks like Canto, Polygon, Arbitrum, Binance BNB Chain, Arbitrum Nova, and Optimism.

Pros:

- User-friendly and intuitive interface enhances usability

- Incorporates advanced trading tools for a comprehensive trading experience

- Enables users to compare prices across multiple exchanges, optimizing decision-making

- Offers functionality for stop loss and limit orders, enhancing trading strategies

Cons:

- Requires user verification, potentially adding an extra step for participation

- Imposes a minimum deposit requirement, which users must meet to engage with the platform

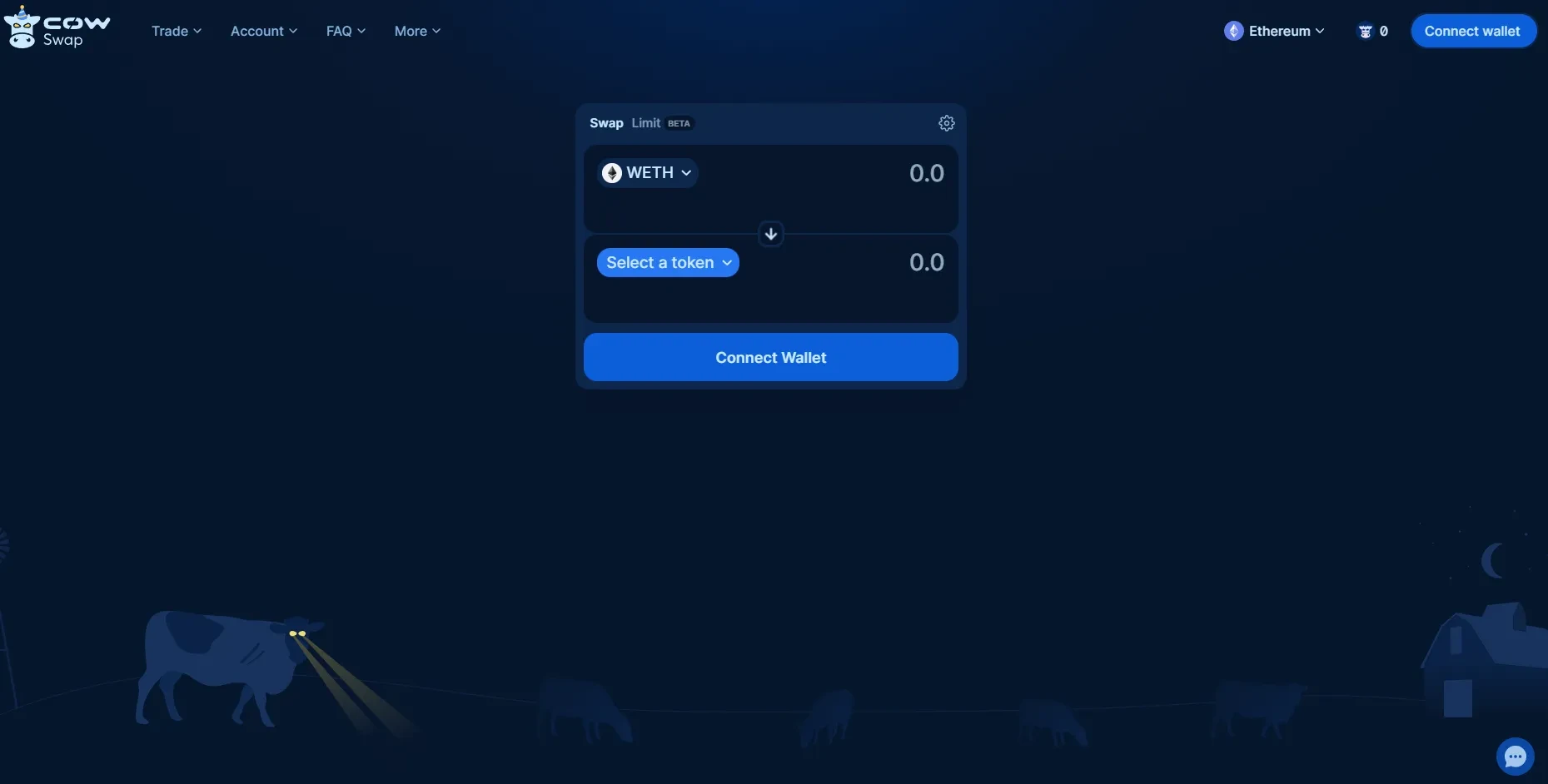

11. CowSwap

Ranked eleventh is CowSwap, a DEX specializing in Ethereum-based token trading by leveraging a supply-and-demand matching system while curbing slippage and fees. Unmatched orders are seamlessly redirected to the underlying AMM, offering users exposure to both trading approaches. CowSwap ensures trade execution at the best on-chain prices across various aggregators and exchanges.

Pros:

- Functions as a fully permissionless Meta DEX aggregator

- Prioritizes high-security measures and privacy protocols to safeguard trades

- Maximizes liquidity for enhanced trading opportunities

- Offers a wide array of token pairs for diversified trading

- Facilitates gas-less trading for off-chain order submissions

Cons:

- Previously targeted in a hacking attack, raising concerns about security vulnerabilities

- Relatively new in the DEX landscape, possibly lacking established trust compared to older platforms

12. IDEX

IDEX, functioning on Ethereum’s network, caters to active traders handling high trading volumes, facilitating concurrent multiple trades and allowing cancellations without gas fees. Providing both market and limit orders, the platform upholds robust security measures through advanced protection protocols. Additionally, IDEX leverages a hybrid approach, utilizing both CEXs and DEXs to bolster trade support and enhance security measures.

Pros:

- Supports approximately 26 tokens, offering diverse trading options

- Offers staking opportunities, adding an avenue for passive earnings

- Gas-free trade cancellations improve flexibility for users

- High-security protocols minimize the risk of security breaches

- Low transaction fees set at only 0.1%

Cons:

- Interface complexity might pose challenges for some users

- Absence of fiat support limits accessibility for certain users

- Requires users to confirm trades using private keys, potentially adding an extra step in the trading process

13. DEX.AG

DEX.AG, an aggregator sourcing liquidity from various DEXs, including some featured on this list, consolidates these platforms to provide users with optimal prices when executing trades. This amalgamation not only ensures favorable pricing but also streamlines the trading process, saving users both time and energy.

Pros:

- Zero fees contribute to cost-effective trading experiences

- Boasts a superior user interface for enhanced usability

- Efficiency in time and energy saved during the trading process

- Offers competitive prices through aggregation across multiple DEXs

Cons:

- Users might incur fees from other DEXs when utilizing the platform

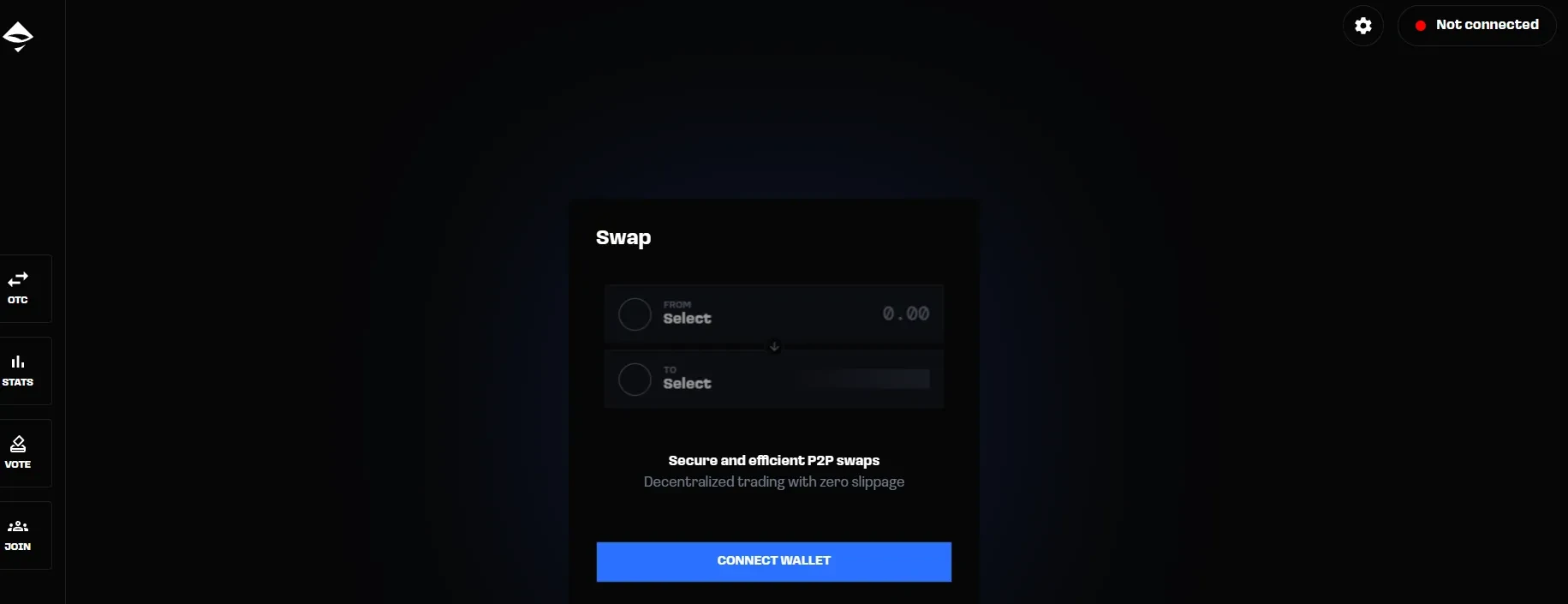

14. AirSwap

Securing the next spot is AirSwap, operating on the Ethereum network, hence necessitating users to cover ETH gas fees. Despite this, the platform itself does not levy any additional charges. Featuring its native token, AST, users can seamlessly swap it with any ERC-20 token. Offering instant deposits and withdrawals, AirSwap ensures a top-notch user experience.

Pros:

- Zero platform fees enhance cost-efficiency for users

- Implements robust security measures, minimizing security risks

- Supports multiple tokens, providing diversified trading options

Cons:

- Completion of Peer-to-Peer trading depends on locating a suitable trader, potentially impacting trade execution timelines

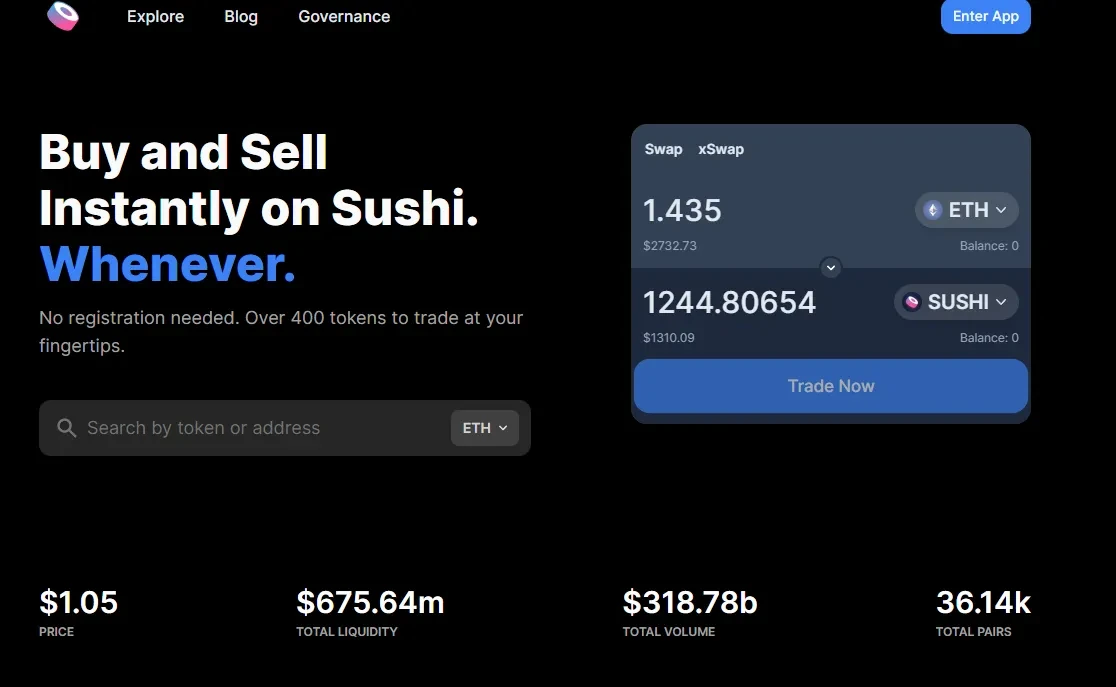

15. SushiSwap

SushiSwap, a prominent DEX in the crypto sphere, stems from Uniswap’s evolution and earns its place among the best decentralized exchanges for several compelling reasons. Its native token, SUSHI, offers avenues for passive earnings through staking and provides governance benefits. Additionally, SushiSwap boasts a unique DEX architecture aimed at mitigating market centralization.

Pros:

- Low transaction fees contribute to cost-effective trading

- Compatibility with a wide range of ERC-20 tokens enhances versatility

- Highly intuitive interface improves user accessibility

Cons:

- Rewards structure might appear complex, potentially complicating user experience

- Limited adoption of cutting-edge technology might hinder innovation compared to competitors

16. PancakeSwap

Next on our list is PancakeSwap, the largest DEX operating on the Binance Smart Chain, renowned for its cost-effective liquidity pools and minimal slippage risk. Functioning as a non-custodial DEX, PancakeSwap employs liquidity pools run by smart contracts on the BSC, enabling automatic trading. Additionally, the platform’s native token, CAKE, finds utility in staking, yield farming, and governance functionalities.

Pros:

- Supports over 50 DeFi tokens, offering a wide array of trading options

- Low transaction fees contribute to cost-effective trading experiences

- Significantly reduces the risk of slippage, ensuring more predictable trades

Cons:

- Users may face the potential risk of impermanent loss associated with liquidity provision

17 WX. Network

WX.Network, previously recognized as Waves, stands as the subsequent DEX on the roster, operating with digital assets like BTC and LTC. The platform introduces an initial coin offering feature, facilitating crowdfunding opportunities. Boasting an intuitive and uniquely designed interface, WX.Network aims to reduce slippage by amalgamating centralized and decentralized functionalities.

Pros:

- Minimal slippage risk enhances trade efficiency

- Operates on its proprietary blockchain infrastructure

- Offers exceptionally low trading fees set at 0.03%

- Intuitive user interface enhances user experience

- Supports multiple assets, broadening trading possibilities

Cons:

- Lack of fiat support might limit accessibility for certain users

- Unregulated status might concern users seeking a regulated trading environment

18. Xfai

Xfai, an innovative DEX, pioneers a distinct approach by implementing an automated market maker model, creating interconnected liquidity pools through on-chain constant function market maker (CFMM) smart contracts. Departing from the conventional token-pair-based constant product market maker, this design targets liquidity fragmentation and high slippage issues. Operating on both Ethereum and Linea chains, Xfai introduces ‘Infinity Staking,’ a unique form of liquidity provision.

Pros:

- Custom design mitigates liquidity fragmentation and minimizes slippage

- Allows trading of various digital assets, enhancing versatility

- Streamlined dashboard for centralized asset management

Cons:

- Inherent risk of impermanent loss associated with AMMs

- Relatively higher swap fee set at 0.4%, impacting trading costs

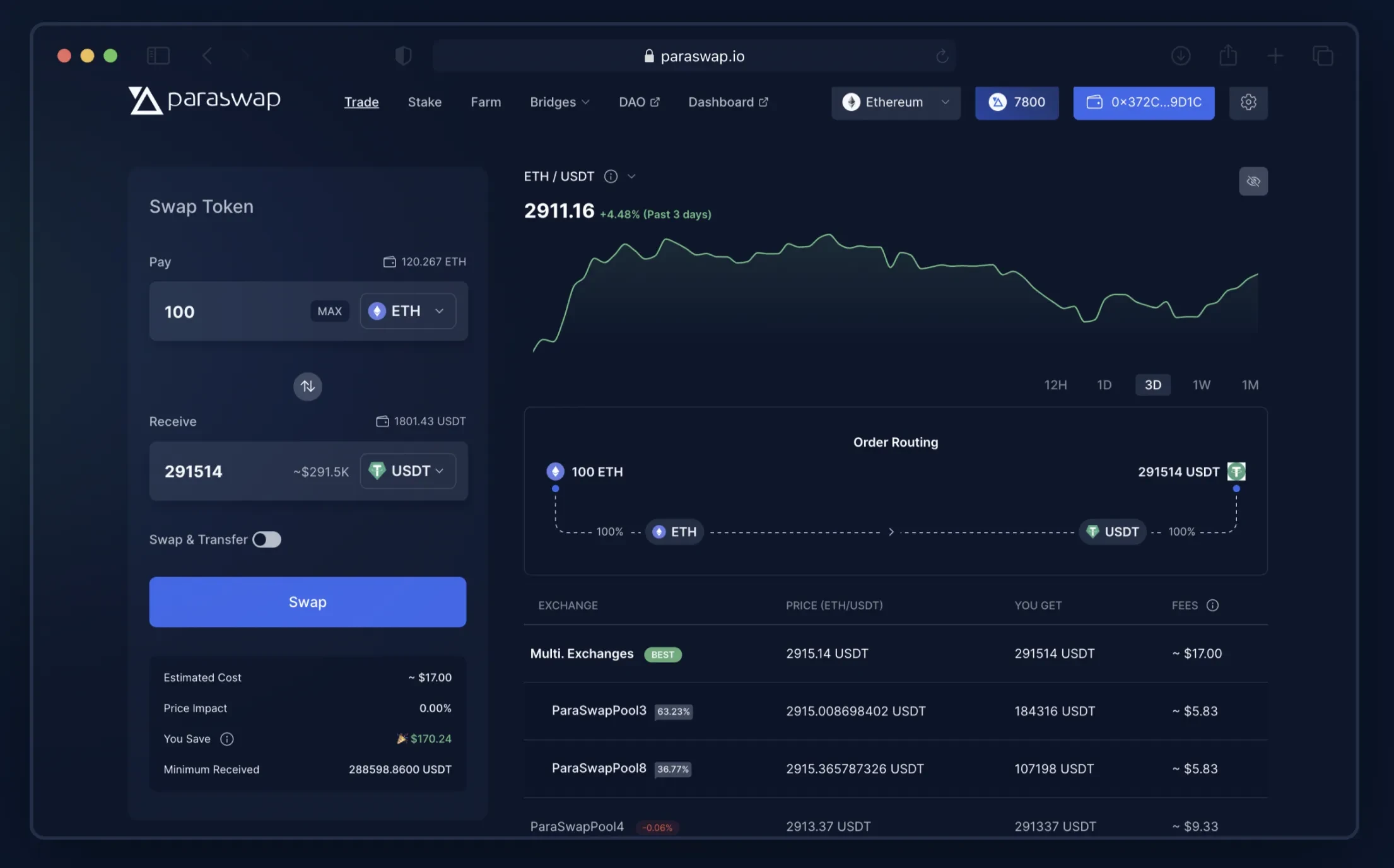

19. ParaSwap

ParaSwap, a widely favored multi-chain DeFi aggregator, strives to grant traders and DApps access to optimal prices, abundant liquidity, and rapid transactions. Achieving this by consolidating DEX and lending protocol liquidity into a secure and unified interface and API, ParaSwap offers intuitive usability. With its combined yield optimization, independent smart contract audits, and advanced charting through API functionality, the platform simplifies the process of discovering favorable prices for users.

Pros:

- Aggregator feature ensures access to the best prices available

- Simplified access to diverse fragmented liquidity pools

- Offers high liquidity for enhanced trading experiences

Cons:

- Inability to directly purchase cryptocurrencies on the platform

- Lack of support for fiat currency transactions in trading

Is Trading Cryptocurrency on DEXs Recommended?

DEXs have become integral to the cryptocurrency trading landscape. Their non-custodial nature ensures your funds remain secure during trades. Transactions are instantaneous, facilitated entirely through smart contracts. However, even the most reputable decentralized exchanges have their drawbacks. Therefore, thorough research before using any platform is crucial.

Which decentralized exchange is considered the best? No single DEX can be universally labeled as the best since each has its unique advantages and drawbacks. The choice of the best DEX depends on the specific preferences and priorities of individual traders.

What’s the largest decentralized exchange? In the crypto industry, Ethereum-based Uniswap stands as the largest DEX in terms of trading volume, a key metric defining its prominence.

Is Binance a decentralized exchange? Contrary to a decentralized exchange, Binance operates as a fully centralized platform in the crypto space, offering custody and related services akin to similar centralized exchanges.

Is Coinbase categorized as a decentralized exchange? Coinbase, like Binance, is not classified as a DEX. It operates as a regulated, centralized platform and holds the distinction of being the largest regulated exchange in the United States.